Understanding Online Forex Trading A Comprehensive Guide 1951815172

Online forex trading has revolutionized the way individuals and institutions engage with currency markets. No longer limited to banks and large financial institutions, forex trading is accessible to anyone with an internet connection and a desire to learn. As the largest financial market in the world, forex trading offers immense opportunities alongside its inherent risks. In this comprehensive guide, we will delve into the fundamentals of online forex trading, discuss strategies to enhance your trading skills, and look at essential tools that can aid both beginners and seasoned traders. We’ll also highlight resources such as online forex trading South Africa Brokers to further assist your trading journey.

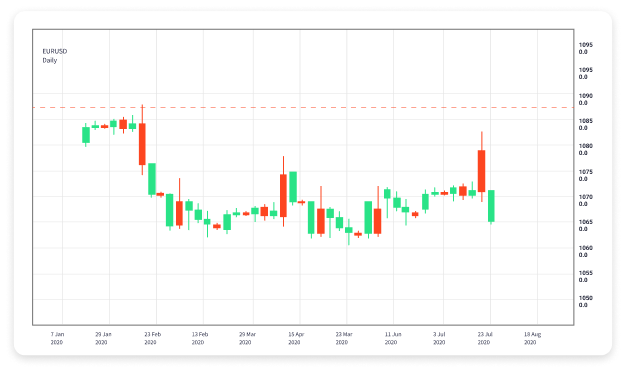

Forex, or foreign exchange, involves the simultaneous buying of one currency and selling of another. Currency trading happens in pairs, with each currency’s value represented in relation to another. Major pairs, such as EUR/USD or GBP/USD, have high liquidity, making them popular among traders. However, forex trading is not just about speculation; it often involves strategic planning, technical analysis, and a clear understanding of market trends.

Understanding the Basics of Forex Trading

To effectively engage in online forex trading, it is crucial to understand the market structure. The forex market operates 24 hours a day, five days a week, thanks to overlapping time zones in major financial centers around the world. This means traders can react to global news and events at any time, providing ample opportunities for profit. Currency prices fluctuate due to a variety of factors including economic data releases, geopolitical stability, and market sentiment.

Setting Up for Success: Choosing a Trading Platform

Your trading platform is your gateway to the market. Selecting the right forex broker, such as one found among South Africa Brokers, can make a significant difference in your trading experience. Look for brokers that are regulated, have a user-friendly interface, provide robust analytical tools, and offer competitive spreads. Additionally, ensure they have good customer support and educational resources that you can utilize as a beginner.

Trading Strategies: Finding Your Edge

Effective trading strategies are vital for success in the forex market. Traders typically fall into two categories: day traders and swing traders. Day traders seek to capitalize on short-term price movements and close their positions by the end of the trading day, while swing traders hold positions for longer periods, looking to profit from medium-term trends.

Some popular trading strategies include:

- Scalping: This strategy involves making small profits on numerous trades throughout the day.

- Trend Following: Traders identify and follow existing market trends, entering trades in the direction of recent price momentum.

- Range Trading: This strategy is used when a currency pair is confined to a specific price range, allowing traders to buy at low points and sell at high points.

The Importance of Risk Management

Risk management is perhaps the most important aspect of forex trading. Understanding how much of your capital you are willing to risk on a single trade is vital for long-term success. Most experienced traders recommend risking only a small percentage of your trading capital on any one trade, typically around 1-2%. Incorporating stop-loss orders to limit potential losses is also essential.

Additionally, traders should diversify their portfolios to spread risk and not rely too heavily on one currency pair. Staying informed with economic news and events, such as interest rate changes or geopolitical tensions, can help in making informed decisions that reduce risk exposure.

Technical and Fundamental Analysis

Two primary types of analysis guide traders in forex markets: technical analysis and fundamental analysis. Technical analysis utilizes charts and historical price data to identify patterns or trends that might indicate future price movements. Traders commonly use various indicators, including moving averages, Relative Strength Index (RSI), and MACD, to analyze price charts.

On the other hand, fundamental analysis examines the economic indicators that affect currency valuation, such as GDP growth rates, employment figures, and inflation data. It is critical for traders to stay updated on global economic news, as major events can lead to significant market volatility and price movements.

Staying Disciplined and Emotionally Grounded

Emotions can be a trader’s worst enemy. Fear and greed can lead to impulsive decisions often resulting in losses. Successful traders emphasize the importance of discipline and emotional control. Establishing a trading plan that includes entry and exit strategies, risk management rules, and performance tracking will help keep emotions in check.

Furthermore, keeping a trading journal can provide insights into your trading habits, helping you reflect on what works and where improvements can be made. Learning from both successes and failures is essential in developing a robust trading methodology.

Utilizing Educational Resources and Community

As a beginner, leveraging educational resources is essential in building knowledge and skills. Many brokers provide free tutorials, webinars, and demo accounts that allow you to practice trading without risking real money. Online forums and trading communities can offer additional insights, allowing traders to share their experiences and strategies.

Furthermore, consider following experienced traders on social media or subscribing to informative blogs that discuss current market trends and strategies. Engaging with these resources not only keeps you informed but also fosters a supportive network during your trading journey.

Conclusion

Online forex trading presents an exciting avenue for those interested in financial markets, but it requires commitment, education, and a sound strategy. By understanding the fundamentals, utilizing the right tools, managing risks, and staying disciplined, traders can navigate the complexities of the forex market effectively. Whether you’re a novice or a seasoned trader, continuous learning and adaptation are key to achieving success in forex trading. Embrace the journey with patience, and you’ll find rewarding opportunities await you in this dynamic marketplace.