How to Reconcile Your Bank Statements in QuickBooks Online

It’s important to perform a bank reconciliation periodically to identify fraudulent activities or bookkeeping and accounting errors. This way, you can ensure your business is in solid standing and never be caught off-guard. Finally, compare your adjusted bank balance to your adjusted book balance. Since you’ve already adjusted the balances to account for common discrepancies, the numbers should be the same.

Join over 6.5 million customers globally.1 Find the QuickBooks plan that works for your small business.

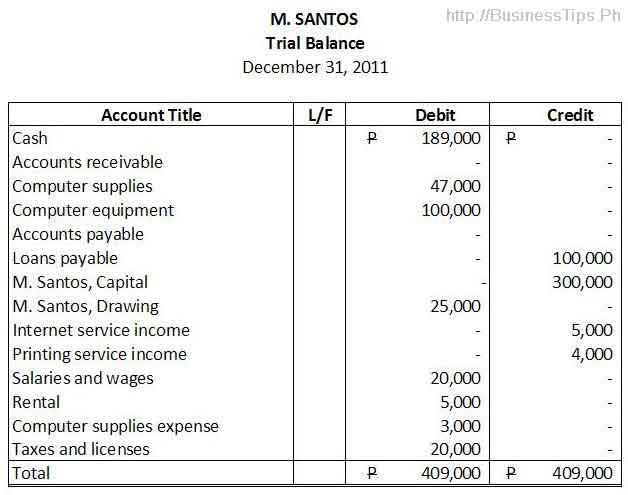

It’s easy to assume that large financial institutions don’t make mistakes, but they do. A few years back, I had checks belonging to someone else clearing in my account for three months in a row. If I hadn’t looked at the checks that were clearing to match them with my transactions, chances are I never would have spotted them. Bank account reconciliation is used to ensure that your general ledger balance and your bank balance match. This is done by noting discrepancies between the two accounts, finding the missing information, and making any additions or corrections in your general ledger.

Step 5: Record All Adjustments As Per Cash Book Into Your Company’s General Ledger Cash Account

Reconciling bank statements with cash book balances helps your business know the underlying causes of these balance differences. Once the underlying cause of the difference between the cash book balance and the passbook balance is determined, you can then make the necessary corrections in your books to ensure accuracy. You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows). If you dread reconciling your bank accounts, using the reconciliation feature in QuickBooks Online will make the task a lot easier. QuickBooks Online makes it much easier to reconcile your bank accounts, and it can reconcile credit card accounts as well.

Beginning cash balances

To get started reconciling how to check if an ein is valid your accounts, just follow this easy three-step process. If you pay your vendors or your employees with a check, you’ll need to keep track of those checks. Most importantly, you’ll need to know how much in outstanding checks you have at the end of the month. Once you’ve completed the balance as per the bank, you’ll then need to work out the balance as per the cash book. At times, you might give standing instructions to your bank to make payments regularly on specific days to third parties, such as insurance premiums, telephone bills, rent, sales taxes, etc.

- All of your bank and credit card transactions automatically sync to QuickBooks to help you seamlessly track your income & expenses.

- To reconcile bank statements, carefully match transactions on the bank statement to the transactions in your accounting records.

- Schedule reports to be generated and emailed daily, weekly, or monthly.

- Bill payments are automatically synced, matched, and categorized in QuickBooks.

- When your balance as per the cash book does not match with your balance as per the passbook, there are certain adjustments that you have to make in order to balance the two accounts.

You can run into the same issue if you use your charge card to pay a bill but forgot to record it in QuickBooks Online. Keeping your financial records in order is hugely important to the success of your business. Read the steps you should take when closing out your small business’ books for the end of the fiscal year. These checks are the ones that have been issued by your business, but the recipient has not presented them to the bank for the collection of payment. However, sometimes there are differences between the two balances and so you’ll need to identify the underlying reasons for such differences.

Book transactions are transactions that have been recorded on your books but haven’t cleared the bank. As a small business, you may find yourself paying vendors and creditors by issuing check payments. If you’re reconciling an account for the first time, review the opening balance. It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks. Over a short timeframe such as a month, differences between the two balances can exist (due to bank errors or checks that have not been cashed by the payee, for example).

NSF checks are an item to be reconciled when preparing the bank reconciliation statement, because when you deposit a check, often it has already been cleared by the bank. But this is not the case as the bank does not clear an NFS check, and as a result, the cash on hand balance gets reduced. Nowadays, all deposits and withdrawals undertaken by a customer are recorded by both the bank and the customer. The bank records all transactions in a bank statement, also known as passbook, while the customer records all their bank transactions in a cash book. To reconcile means to “make one view or belief compatible with another.” In accounting, that means making your account balances equal to one another. More specifically, a bank reconciliation means balancing your bank statements with your bookkeeping.

When your business receives checks from its customers, these amounts are recorded immediately on the debit side of the cash book so the balance as per the cash book increases. However, there may be a situation where the bank credits your business account only when the checks are actually realised. When your business issues a check to suppliers or creditors, these amounts are immediately recorded on the credit side of your cash book. However, there might be a situation quickbooks online advanced coming soon to quickbooks online accountant where the receiving entity may not present the checks issued by your business to the bank for immediate payment. The debit balance as per the cash book refers to the deposits held in the bank, and is the credit balance as per the passbook.

When you’re done reviewing your statement, you’ll know everything made it into QuickBooks. Before you start with reconciliation, make sure to back up your company file. Give your accountant direct access to your books marginal cost formula and calculation so she can find the reports and information she needs when questions arise. Create a separate login for your accountant to make it easy for her to work with you.