FIFO Definition What is the FIFO data retrieval method?

FIFO is required under the International Financial Reporting Standards, and it’s also standard in many other jurisdictions. Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design.

Here are answers to the most common questions about the FIFO inventory method. Because FIFO assumes that the lower-valued goods are sold first, your ending inventory is primarily made up of the higher-valued goods. Additionally, any inventory left over at the end of the financial year does not affect cost of goods sold (COGS). The FIFO method is allowed under both Generally Accepted Accounting Principles and International Financial Reporting Standards. The FIFO method provides the same results under either the periodic or perpetual inventory system.

Choose a region & language

- We provide worry-free warehousing and fulfillment so you can focus on expanding your business, and we’d like to tell you how it works.

- FIFO and LIFO aren’t your only options when it comes to inventory accounting.

- If the retailer sold 5 shirts during the year, how does he know which shirts were actually sold—the shirts purchased in May or the ones purchased in June?

- Our customers have access to a broad network of industry partnerships, EDI connections, retailer relationships, ERP, and ecommerce integrations.

And lastly, overlooking software capabilities can hinder FIFO implementation. Businesses should fully utilize the features of inventory management software. The food and beverage industry relies heavily on FIFO to ensure product safety and quality. Given the perishable nature of many products, FIFO helps in minimizing spoilage and waste. This method also aids in compliance with food safety regulations and maintaining customer satisfaction by ensuring that the freshest products are available for sale. Manufacturers benefit from FIFO by maintaining a consistent flow of raw materials and finished goods.

FIFO vs. LIFO

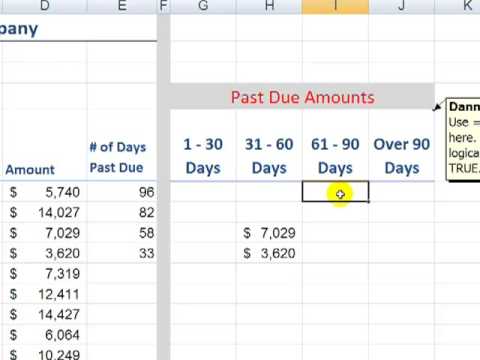

- Using a FIFO calculator or inventory management software can simplify this process.

- FIFO is an accepted inventory costing method in the U.S. using Generally Accepted Accounting Principles (GAAP).

- Industries with highly volatile inventory costs or where the latest inventory costs are crucial for pricing strategies may find FIFO less useful.

In inventory management, the FIFO approach requires that you sell older stock or use older raw materials before selling or using newer goods and materials. This helps reduce the likelihood that you’ll be stuck with items that have spoiled or that you can’t sell. Help with inventory management is one of the many benefits to working with a 3PL. You can read DCL’s list of services to learn more, or check out the many companies we work with to ensure great logistics support. The remaining 50 items must be assigned to the higher price, the $15.00. FIFO stands for “first in first out” and involves selling the oldest inventory items first.

Higher Valuation for Ending Inventory

It is an inventory management method where the oldest inventory items are sold, used, or shipped out first. The purpose of FIFO is to ensure proper stock rotation, minimize waste, and maintain the quality of products, especially perishable or time-sensitive goods. Therefore, it will provide higher-quality information on the balance sheet compared to other inventory valuation methods. The cost of the newer snowmobile shows a better approximation to the current market value. As prices fluctuate throughout the year, FIFO inventory accounting helps Garden Gnome keep track of its true cost of goods sold.

What are the benefits of using the FIFO inventory method?

FIFO accounts for this by assuming that the products produced first are the first to be sold or disposed of. As you can see, the FIFO method of inventory valuation results in slightly lower COGS, higher ending inventory value, and higher profits. This makes the FIFO method ideal for brands looking to represent growth in their financials. The average cost method, on the other hand, is best for brands that don’t see the cost of materials or goods increasing over time, as it is more straightforward to calculate. The weighted average cost method calculates COGS and ending inventory based on the average cost of tax form 8959 fill in and calculate online all units available for sale during the period.

For inventory tracking purposes and accurate fulfillment, ShipBob uses a lot tracking system that includes a lot feature, allowing you to separate items based on their lot numbers. Notice that Susan lists the 130 units remaining in her inventory as costing $4 apiece. This is because she presumes that she sold the 80 units that she bought for $3 apiece first. At the end of her accounting period, she determines that of these 230 boxes, 100 boxes of dog treats have been sold.

It’s also an accurate system for ensuring that inventory value reflects the market value of products. Thus, the FIFO method reports lower costs of goods sold on the income statement and tax return than the company actually incurred for the year. This is a common technique that management uses to increase reported probability. Lower costs and higher profits translates into higher levels of taxable income and more taxes due. This inventory method allows companies to keep track of inventory and cost of goods sold without actually knowing what specific pieces of inventory were sold during the year. In other words, a retailer might buy 10 shirts in May and 20 shirts in June.

This article has provided an in-depth exploration of the FIFO method, covering its principles, implementation steps, advantages, and disadvantages. Key takeaways include the method’s alignment with actual inventory flow, its financial benefits, and the potential for higher tax liabilities. Choosing the right inventory valuation method is crucial for accurate financial reporting and efficient inventory management. While FIFO offers numerous advantages, it is essential to consider the specific needs and circumstances of your business.

With best-in-class fulfillment software and customizable solutions, we provide hassle-free logistics support to companies of all sizes. A team of fulfillment fanatics who care about our clients’ businesses like their own. We see things from our customers’ perspective, and have the guarantees to prove it. “FIFO vs. LIFO is always trying to optimize costs or movement of goods,” Arnold says. “Clients who choose a LIFO model have to reassess their older inventory,” he notes. That might mean periodically marking it down or otherwise clearing it out.

Adopting the FIFO method can streamline inventory management and enhance financial accuracy, but successful implementation requires careful planning and execution. Businesses must consider various factors, from selecting the right software solutions to training employees and maintaining accurate records. This section provides a detailed guide on best practices for implementing FIFO, common mistakes to avoid, and how to leverage technology to facilitate the process. By following these guidelines, businesses can ensure a smooth transition to FIFO and reap the benefits of this efficient inventory valuation method. Implementing FIFO can be streamlined with the use of specialized inventory management software. These solutions automate the tracking of inventory purchases and sales, ensuring accurate and efficient implementation of FIFO.

We can help you determine optimal inventory levels, add visibility to your supply chain to improve operations, choose between FIFO vs. LIFO methods, and keep your storage costs as low as possible. The FIFO method impacts how a brand calculates their COGS and ending inventory value, both of which are always included on a brand’s balance sheet at the end of an advantage of a classified balance sheet is that it is easy to see: a financial accounting period. Along with the best practices, come a series of common mistakes we caution you to avoid.

For instance, if cpa vs accountant a brand’s COGS is higher and profits are lower, businesses will pay less in taxes when using LIFO and are less at risk of accounting discrepancies if COGS spikes. However, brands using LIFO usually see a lower valuation for ending inventory and net income, and may not reflect actual inventory movement. It is an alternative valuation method and is only legally used by US-based businesses.

In contrast to the FIFO inventory valuation method where the oldest products are moved first, LIFO, or Last In, First Out, assumes that the most recently purchased products are sold first. In a rising price environment, this has the opposite effect on net income, where it is reduced compared to the FIFO inventory accounting method. Using the LIFO method for inventory accounting usually assigns a higher value to the cost of inventory than FIFO. That’s because the last items purchased often have higher prices (though sometimes the reverse is true, and the most recent costs are lower). LIFO may reduce your taxable income, but it will also make your P&L statement look less favorable. In addition, showing higher inventory costs on your balance sheet will decrease your profits, at least on paper.

Whether you pick and pack orders from the most recent inventory (LIFO) or the oldest inventory (FIFO), optimizing stock levels is essential to keep the total cost of inventory storage low. First in, first out — or FIFO — is an inventory management practice where the oldest stock goes to fill orders first. FIFO is also an accounting principle, but it works slightly differently in accounting versus in order fulfillment. ShipBob finally gave us the visibility and analytics we were looking for.